Securing a difficult Currency Loan which have the second Financial beside me

- Lower Borrowing Standards

- Rate

- Deeper Negotiability inside Installment Options

With a hard currency financing, you can use equity from other properties you currently have available. Terms and conditions is actually subject to both their considering state and the worthy of of your house.

- Perfect for Short-term Solutions

Particularly if you’re looking to order another type of house with plans to possess renovating it getting coming product sales (otherwise house-flipping.) But if there clearly was a pressing scientific bills, divorce case or other high priced problem, hard money money could be a whole lot more perfect for your versus old-fashioned bank loans.

Disadvantages

- Higher Rates

Since the detailed, sometimes interest levels is arrive at around 18 percent-which can be perhaps not best for the majority of people. However, because most anybody trying to get hard currency fund are just will be credit getting 6 months to one seasons, it may sooner be much less than you would imagine.

- Brief Service

Think of, this will be a connection to obtain of an immediate gap. Difficult money is perhaps not a long lasting services and should naturally end up being regarded as a temporary income provider.

- Scarcity

Whenever you are difficult money loan providers are becoming increasingly more apparent, it continue to have neither committed, presence or marketing divisions once the conventional creditors. You will probably find doing your research for most readily useful speed usually end up being very limited personal installment loans Salt Lake City UT.

Are hard Money Loan providers Reliable?

For the most part, sure. They may be private traders, but they might be just as much susceptible to legal regulations once the traditional loan providers. And even more scrutinized. Hard currency lenders remain industrial entities. No commercial entity desires deal with prosecution-specifically an option financial.

But with one legally joining arrangement, review new price meticulously; which have an attorney, essentially. Make certain that there are no loopholes built to take advantage of your if you are considering a challenging currency loan. And constantly find out about this new negotiability regarding readily available conditions.

As a skilled a residential property buyer I am also an arduous money lender and can direct you from the process of protecting a difficult currency mortgage with a second mortgage:

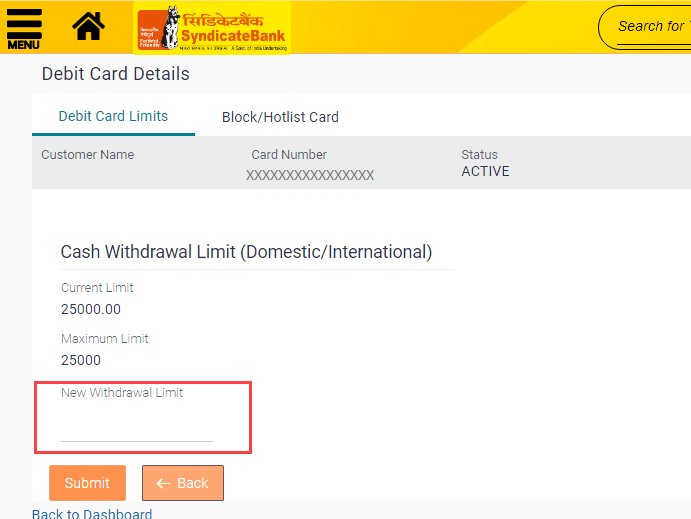

1. Researching your house collateral

I can help you determine how far collateral you have got inside the your house from the deducting new an excellent harmony on your own number one financial out of your house’s market well worth.

dos. Punctual and Credible Financing

We bring a level of believe and you may reliability that you may maybe not see that have unfamiliar third parties. By the doing work actually with me, you could avoid a long time waiting periods often with the traditional lenders.

step three. Planning Your application

I am going to direct you towards finishing the mortgage app, providing information about their priount out-of security you have, and also the function of the loan. I’m able to together with make it easier to collect the necessary support documents, particularly proof of money, assets assessment, and you may an in depth description of your own home project or purpose where you have to have the mortgage.

cuatro. Possessions Appraisal

I can accentuate the newest assessment of your own top household to choose the most recent ount of security available to support the loan. That it appraisal is a life threatening reason for determining the mortgage-to-worthy of (LTV) ratio, and therefore affects the mortgage matter and you can terms and conditions.

5. Financing Recognition and Closure

When i have examined the application and you will used my homework, I could pick whether to approve the loan. I am able to assist you from the loan agreement process, outlining new terms, interest levels, and you can fees regarding the financing. Up on finalizing the arrangement, I’m able to place an effective lien in your top household, hence serves as guarantee for the mortgage.